Life Sciences & Health

Put Science at

the service of life

A business request?

You want to join us?

Whether it is investing in a lightning-fast quest to develop drugs and vaccines to combat global pandemics, developing cutting-edge technologies to enhance research possibilities or coping with an everchanging regulated environment, the Life Sciences industry is constantly transforming, adapting, and innovating.

The Life Sciences & Health industries consist of companies operating in the fields of pharmaceuticals, biotechnology, medical devices, biomedical technologies, nutraceuticals, cosmeceuticals, food processing, and others that are dedicated to creating products and solutions to improve the lives of organisms.

Despite being among the most heavily regulated industries in the world, the Life Sciences industry remains one of the most attractive. The overall market is steadily growing because of increases in the worldwide population, access to medicine in developing countries, ageing populations in developed countries, and, circumstantially, the demands of global pandemics on public health.

The impact of global health crises

While economic downturns are inevitable, there has been a paradigm shift across the Life Sciences sector, driven by the global pandemic: global R&D collaboration, strategic re-localisation of product development and manufacturing, and specific reactive regulatory facilitation of systemic and coordinated prevention.

Newly developed processes, used to combat the COVID-19 pandemic, are now being used in the research & development of new drugs and therapeutic products via more efficient clinical trials. Alongside this, the industry has attracted considerable interest and investment in many innovative projects, such as new digitalised processes to improve production performance and smart factories.

ALTEN: Empowering Innovation in the Life Sciences Industry

Consequently, the Life Science leaders of tomorrow will be those who adapt to the changes, those with a clear vision, ready to grab new opportunities and face challenges, building up collaboration beyond traditional players, and seeking the best available resources and partners on the market.

As the European consulting leader in the Life Sciences industry, ALTEN accompanies its clients in developing and manufacturing Life Sciences products focusing on 2 main business lines:

- Clinical Research Outsourcing (CRO) services

- Life Sciences Manufacturing Operations (LSMO)

ALTEN in the Life Sciences industry

350 M€

2022 turnover

+3,000

consultants

25

countries

300

clients

6

domains of expertise in Life Sciences: Pharmaceutical Industry, Biotech, Chemicals, Cosmetics, Agrifood, Medical Devices.

What are the market trends in the Life Sciences industry?

Faced with new and changing regulations, the pharmaceutical and medical device industries have an obligation to comply.

For example, the implementation of the EU Falsified Medicines Directive, initiated in 2018, will make it possible, between 2026 for class III custom-made implantable devices and 2028 for all the other devices, in most of the 28 EU Member States, to track and identify each box of medicinal product using a unique serial number. This number, represented by a QR code printed on the packaging of the product, is registered in a European Union database and is checked by the Pharmacist before the drug is given to the patient, thus eliminating any risk of counterfeiting.

Challenges:

- Qualify and validate the production and distribution systems impacted

- Master the regulatory issues related to the emergence of combined products

- Anticipate potential future requirements such as aggregation

- Change and update existing processes and systems to ensure regulatory compliance

All medical devices are potentially connectible. Some are already connected and working through applications that provide health professionals and patients with decision aids, diagnostic possibilities or automatic treatment management. There are many areas of application, including telemedicine, addiction management, and chronic disease management.

Experiencing a growth rate above 10% per year, the e-health market is estimated to be worth $400 billion by 2022.

Challenges:

- Develop these embedded softwares in compliance with the regulatory standards of the target market

- Prove the regulatory compliance of these products, which is complex due to the requirements related to the status of DM (Medical Device) and the presence of a software

- Ensure personal data security and stakeholder trust

A combination product is a health product in which a drug and a medical device are combined. Similarly to an embedded software, innovation and technological progress are making this type of alliance possible more and more and here again the fields of application are numerous. One association that has become commonplace is the combination of hip replacement and antibiotics, which aims to inhibit bacterial adhesion.

For the manufacturers, the issue is complex because these “borderline” products have only one status, Drug or DM, and that each status has its own specific regulatory regime. Here, the regulatory strategy is the most important, from the design phases.

Challenges:

- Master both the normative constraints of DMs and those of drugs, to develop a registrable combined product

- Validate the manufacturing process for these combination products

- Be able to qualify and classify the combined product to determine the applicable regulatory status, and file for registration

The pharmaceutical industries must produce more at a competitive cost in order to meet the budgetary efforts required by health systems, increased competition from generic drugs and growing demand from emerging countries.

In 2017, the global drug market exceeded the threshold of 1,000 billion dollars of revenue, increasing by 6% compared to 2016, with a market share in the United States of 49%.

Challenges:

- Share R&D investments

- Renew production tools (e.g.: automation)

- Requalify these upgraded production sites

- Developing new, highly flexible production methods for individualised treatment methods of the future

ALTEN VALUE PROPOSITION

Functional sectors covered by ALTEN

- Clinical Operations

- Data analytics

- Clinical Quality

- Vigilance & Medical Information

- Regulatory & Market Authorisation

- Manufacturing (Production, Packaging)

- Supply chain, Logistics, and Purchasing

- Manufacturing 4.0

- Lean 6/Sigma and continuous improvement

- R&D

- Tech Transfer, NPI, NPD

- Engineering (Maintenance and Commissioning)

- Validation (Q&V, CSV, V&V)

- Engineering 4.0

- PMO, PM

- Regulatory Affairs

- Quality Assurance

- Quality Control

- Quality 4.0

OUR SUCCESS STORIES

In order to be able to launch large-scale clinical trials (phase 3) of a new vaccine, one of the ten international pharmaceutical industry giants has invested in the construction of a new production site in Belgium. ALTEN has been entrusted with the responsibility of qualifying equipment performance (PQ) and drafting the operating instructions.

In the context of developing an immunosuppressive drug for post-renal transplant patient, a global leader in generic and biosimilar medicines outsourced the study of the benefits of the pharmacokinetics profile of its product to AIXIAL (specialized subsidiary of ALTEN Group).

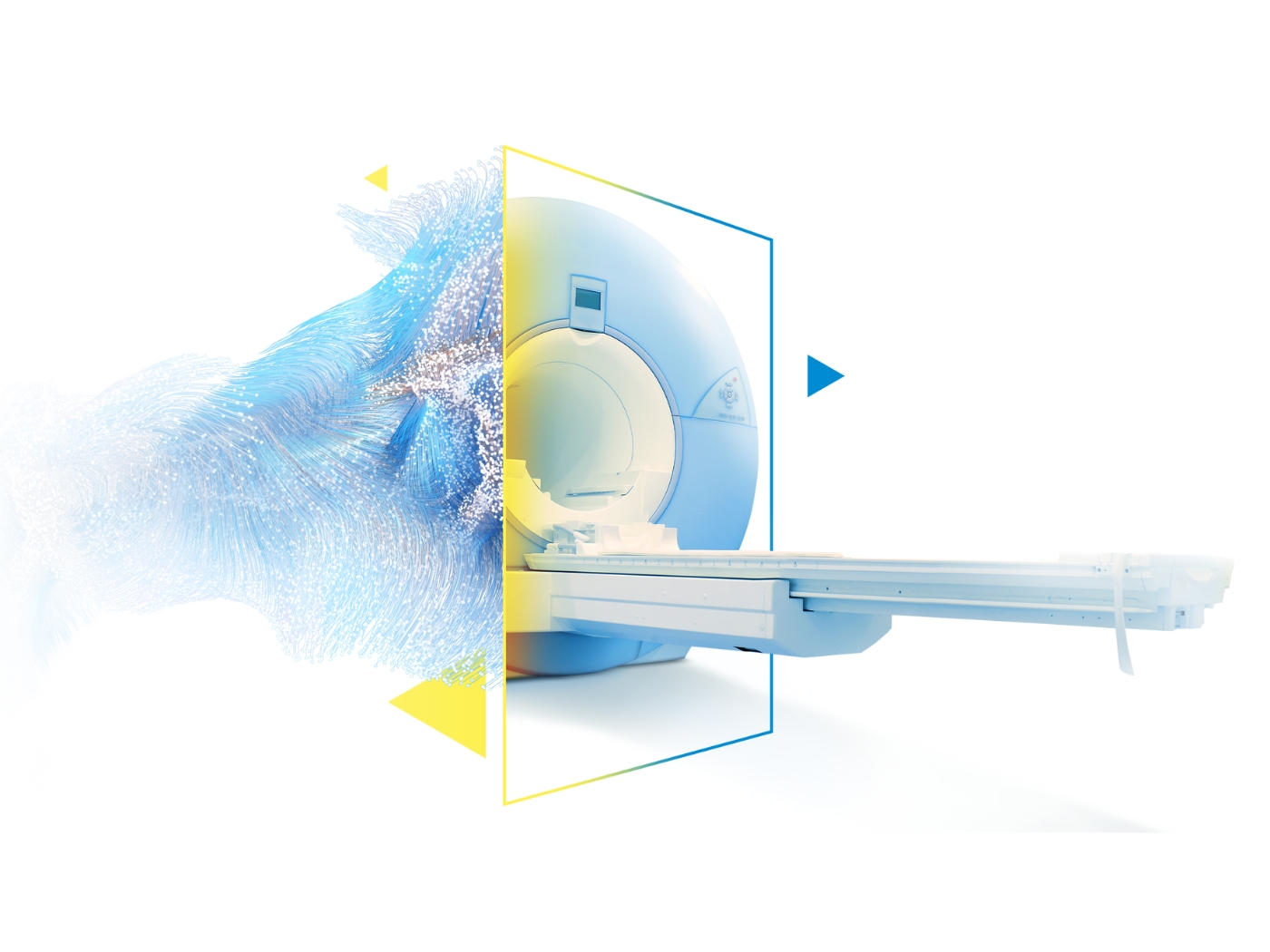

ALTEN has recognized expertise in medical devices and has set up two service centres (Software and Hardware) to support the activities of the R&D centre of one of the world’s leaders in medical imaging. The work carried out by our engineers is in the fields of mammography, interventional radiology, and the development of advanced medical imaging applications.

The growing use of digital technologies in pharmaceutical industries, in particular, makes CSV (Computer System Validation), which controls the automated production of drugs, necessary. This validation provides the documented proof that a software application or a computer system will operate continuously and will therefore meet predefined GxP (Good Practice) guidelines.

OUR CLIENTS

Pharmaceutical industry

Pfizer, Abbvie, Sanofi, Johnson & Johnson, Novartis, GSK, Lonza

Biotech

Novo Nordisk, Moderna, Thermo Fisher, Gilead, Amgen

Cosmetics

Pierre FABRE, L’OREAL

Agrifood

Syngenta, Danone

Medical device industry

Abbott, Siemens Healthineers, Roche, Becton Dickinson et BioMerieux